Range continues for most pairs, and traders and investors have a difficult time picking a direction.

Under these circumstances the only thing we can do is trade when there are very clear signals about short-term movements.

I, personally, cannot come up with a different strategy right now.

What do I have in mind?

On most charts you can see a signal that is very clear and appears many times during the day, and it can be traded with a relatively low risk, especially during a bullish trend. I am referring to a candlestick with a small body, a long shadow on the bottom and a very short shadow on the top, which we know as a hammer or a pinbar candlestick. Such a candlestick that has formed above a support level is a great signal to open a long position. Usually the larger the time frame the candlestick appears on, the more long-term the signal it provides is. You can find such candlesticks both on the 5-minute and the 4-hour time frames.

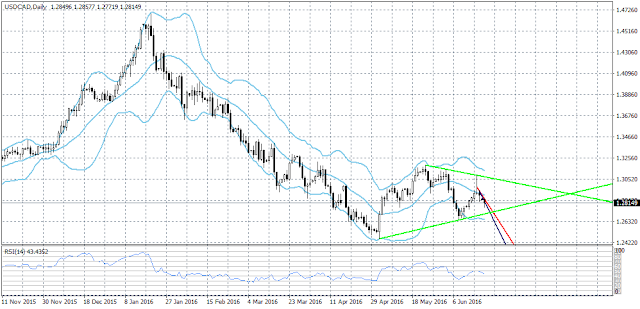

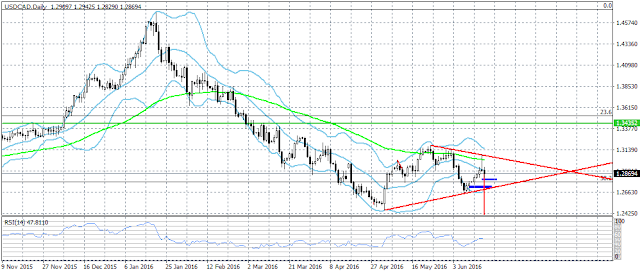

Here you can see a few examples of such setups.

There are many other setups based on the price action strategy, but they are much more complicated than that, which is why I am not writing about them in this post. The pin bar (or the bullish hammer) is the most popular signal, as well as the most easily recognizable one, which is why I decided to write about it.