Thursday, March 30, 2017

USD/CAD Finally Started Falling

The impractical thing about trading on the large time frames is that everything develops very slowly and one needs to be very patient.

Despite that, one feels satisfaction when their prognosis comes true and the expected movement does occur, the way it happened with USD/CAD.

I think that the barbed wire pattern finally developed fully and the last bearish bar from yesterday 29th March 2017 completely engulfed the bodies of the last ten daily bars before it. In my opinion, that is the beginning of the expected move to the downside.

Since in this case I am examining the movement on the daily time frame, I think that the first target to the downside is 1.3250, but that is a support that shouldn’t be too difficult for the bears to break out below on their way down.

I think that the target after that is around 1.3160 – 1.3150.

Let me also remind you of my expectation that the limit of the flag on the weekly time frame is around 1.2450.

Of course, these are 900 pips and obviously this is at least a medium-term target.

Wednesday, March 29, 2017

Article 50 Was Triggerred Or Much Ado About Nothing

GBP/USD and EUR/GBP practically remained range-bound, which means that the news has already been traded.

Under such circumstances we could only turn to technical analysis.

Regarding GBP/USD – the pair I prefer trading, I think that there will be a drop to 1.2250 – 1.2200.

I also think it is possible for the drop to deepen and for the pair to continue toward 1.2000 – 1.1970, i.e. toward the support marked by the red trend line.

For now it seems that the range will continue for a little while longer, until the market picks a direction.

Tuesday, March 28, 2017

The Expectations For A GBP Drop Remain Valid

Despite the expectations that the GBP/USD pair would drop, it continued rising with no significant correction and rallied for about 500 pips.

From a technical analysis point of view, however, the 126.00 level is a strong resistance both on the daily and the weekly time frames.

And since this is a currency pair that could be considered “illogical”, which in recent months strongly depends on politics, we cannot overlook the fact that that the expectations for a drop grow due to the fundamental conditions too – it has been confirmed that tomorrow, 29th March, the British Prime Minister Theresa May will trigger Article 50 for the UK to leave the EU. Under such circumstances it would be illogical to believe that the GBP will continue rising. I think we could rather expect a move to the downside.

So in my opinion, for the moment the expectations for a GBP drop remain valid.

Monday, March 27, 2017

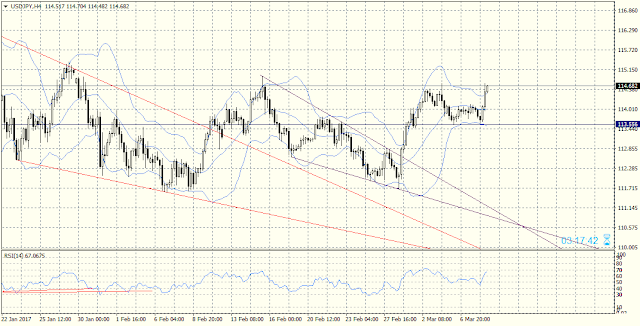

USD/JPY Could Begin A Correction

USD/JPY picked the scenario where it fell directly after the breakout below the support zones marked by the blue rectangles on the screenshot, with the correction to the upside being insignificant and barely testing the resistance zone after which it fell with over 130 pips.

Despite all that I think that a correction to the upside is possible. These are my reasons why:

-On the H4 time frame the pair reached a support at 110.10.

-The bars that have formed are a signal for a possible move to the upside.

-The volumes of the long positions of the bullish bars above the support are increasing.

-And last but not least, there is a RSI divergence between the last two lows on this time frame.

I think that in case the pair does begin a correction it could reach 113.00 – 113.50.

On the other hand, if USD/JPY continues falling, I think it will aim for 109.50 – 109.00. In that case we should watch out for new, higher lows of the RSI indicator compared to the currency pair – i.e. signs that the divergence is deepening.

Friday, March 24, 2017

USD/JPY Today

USD/JPY managed to break out below both support zones I spoke about in my previous assessment of that pair and fell to 110.625, but apparently the next strong support is at that level, because the pair has stalled there for forty hours now.

I do think, however, that USD/JPY could fall even lower, toward 108.80 – 108.50.

In my opinion, there are two most likely scenarios:

The pair will either test and break out below the support at 110.60, or, after it tests this level, it will rebound from it and move to the upside to test the previous support in the zone around 111.60 – 111.90, after which it will move to the downside again.

I also think that it will become clear quite soon which scenario the market will pick.

Thursday, March 23, 2017

I Expect USD/CAD To Begin Falling

During the past eleven months we witnessed what looked like an endlessly developing flag on the USD/CAD charts.

In my opinion, that flag has fully developed now, with all necessary characteristics to be defined as such a pattern:

-Slightly converging trend lines.

-Four points at which the pair has reached them and a breakout at the fifth.

-A retracement to test the trend line the pair broke out below.

On the daily time frame, right below the broken through trend line there is also a well-developed barbed wire pattern.

At the moment the pair is consolidating right under the support trend line and if one is having a more aggressive trading approach now would be time to open short positions, but if they’re more conservative they could wait for the beginning of a move south in order to open such positions.

If the pair does begin falling the short positions could be opened from 200 pips higher than the initial breakout at 1.3175.

If it does move to the upside, then the target would be at 1.36, but I think such a scenario is not very likely.

Wednesday, March 22, 2017

The GBP/USD RSI Divergence Hints At A Move To The Downside

The move to the downside is logical, because the pair rallied with almost 400 pips without any significant correction, and we can count on the chart not seven, not nine, but thirteen waves to the upside. That is a quite the rare case, usually after nine sub-waves there is a deeper correction than the one we witnessed here, but now we could expect said deeper correction to occur.

The RSI divergence is present on the M15, H1 and H4 time frames.

On the H4 time frame the limit of the divergence is around 1.2250.

Of course, we should not overlook the possibility for a new move to the upside, after the correction is over. I think that the target to the upside is at 1.2550 – 1.2600.

Tuesday, March 21, 2017

The ActivTrades’ Education Centre

The mark of a great broker is not just facilitating trading, it is also aiding people in developing their skills and expanding their knowledge about trading. These are exactly the kind of services the independent online broker ActivTrades is offering you.

Visit the ActivTrades Education Centre, a free education hub, regardless of your level of expertise – everyone from novices to experts can learn something new and useful. Take part in live interactive events led by professional speakers.

ActivTrades organizes a wide range of webinars that will help you improve your skills as a trader. The broker also offers one-to-one training, which is tailored to your needs, where an ActivTrades trading expert can help you learn how to make the most of the broker’s products and services.

But that is not all!

ActivTrades also offers video tutorials, seminars and trading tours, courses, and last but not least, daily market analysis written by an expert.

Take advantage of any or all these excellent services to become a better trader!

Visit the ActivTrades’ Education Centre now!>>>

Monday, March 20, 2017

USD/JPY Is Attempting A Third Test Of The Support At 112. 00 – 111.60

My prognosis for USD/JPY wasn’t as correct as it was for the GBP/USD and USD/CHF pairs.

Although FOMC raised the interest rate the USD dropped sharply and the pair fell with over 160 pips during the news, while the entire drop from the high at 115.49 (on the 10th March 2017) so far has been over 300 pips.

At the moment the USD has reached a strong support zone around 112.70 – 112.40, and if it breaks out below it, the next support zone to the downside is at 112.00 – 111.60.

Whether the pair will break out below it too is difficult to tell at the moment.

In case it does break out below both support zones, I think the move to the downside could continue to 108.50 – 108.00.

As we know, however, when the price tests one zone three times and fails to break out above or below it, it usually rebounds from it and sharply moves in the opposite direction. That is why it is important to see what will happen during this third test of the support zone.

Friday, March 17, 2017

USD/CHF Could Fall To 0.9843 At The Very Least

At a first glance the behavior of the market appears odd. FED hiked the interest rate, but the various currencies reacted with sharp and strong movements against the USD.

My prognosis that USD/CHF will fall, however, came true.

When it came to this pair I followed the logic of what I saw on the chart, rather than what should happen with such a (at a first glance) strong dollar.

Of course, by principle I have always preferred technical to fundamental analysis.

Either way, there is a very real chance that the USD/CHF pair will reach the limit of the pennant pattern it formed, and that means that it will reach at least 0.9843.

Thursday, March 16, 2017

The Prognosis For A Move To The Upside For GBP/USD Was Fulfilled

Although the GBP dropped a little more since my last assessment, my prognosis for a move to the upside for GBP/USD turned out to be correct.

The pair moved a little further down, but could not reach 1.21 after which the GBP started rising, and at the moment it’s around 1.2360.

My expectation is that the move to the upside will continue, and the first serious resistance level will be around 1.2440 – 1.2450. In case the pair breaks out above that level we could see it rise toward 1.2600 and even higher.

If the GBP cannot break out above the resistance trend line (in blue), I think it will drop toward 1.22.

Wednesday, March 15, 2017

USD/JPY Will Pick A Direction After The FOMC News (Or Is There A Vision For It Already?

I admit that the title may sound somewhat provocative. It is also logical, because I know two types of traders with two different opinions regarding the role the important news events play in the movement of the financial markets.

One type of traders think that the news move the markets.

The other type think that the news are mainly a catalyst of the movement, but technical analysis is what ascertains the movement direction.

So, will the market pick a direction after the Federal Funds Rate announcement (which is expected to be hiked) or is the direction already chosen and the news will only be a catalyst?

Regardless of the amount of questions related to the situations, here is what we can see on the chart:

On the daily time frame the pair has been rebounding from the zone around 114.50 – 114.70. In my opinion, this is an obvious and strong support zone. Still, it’s not an impenetrable wall, there could be a breakout under the right conditions.

On the H4 time frame the pair has formed a pattern that strongly resembles a triangle with four points at the trend lines.

My expectation is for a continuation of the move to the upside, which could be confirmed by a breakout above the triangle. In case of a rate hike, that is the logical conclusion.

What will happen, however, if the rate remains as it is? The most probable scenario is strong volatility, which will last at least for a few hours. After that I think the pair will probably break out below the support and the first target to the downside is at 114.00 – 113.80.

Tuesday, March 14, 2017

Technical Analysis Says USD/CHF Should Start Falling. Traders Are Waiting For The Fed News

I have drawn the main trend lines of the USD/CHF movements for the past two months and they support the logical expectation that the pair will begin moving to the downside.

There is a breakout below the wedge from 0.98694 to 1.01689, but the pair is in no hurry with the move to the downside, even though its limit is 248 pips.

In my opinion, it is quite possible for the situation to remain without much further development until tomorrow, when FED will announce a possible change in the Federal Funds Rate. There are expectations that the rate will be hiked, and that could lead to a change in the expectations for a move to the downside.

However, the market sometimes reacts oddly to such news and it is still not clear whether that will be the case tomorrow. After the possible news for a rate hike it could jump to the upside and then to continue falling.

There are 24 hours until said news comes out, so we will soon find out which scenario the market will choose.

Monday, March 13, 2017

The GBP/USD Target To The Upside Is At 1.2300

Obviously the zone around 1.2130 proved to be a quite strong support for the pair, because after three days of range at that level it finally began climbing.

This move to the upside was hinted on one hand by the bars on the daily time frame (two inverted hammer bars) and on the other hand by the RSI divergence on the H4 time frame between four lows.

For the moment the priority scenario is a GBP move to the upside, with a first target at 1.23.

The limit of the divergence, however, is at 1.24118, so in my opinion, there is no need to analyze the short-term scenario for a move to the downside.

However, we should not forget that on 15th March (Wednesday) there will be important data coming from the USA that could change the situation.

Friday, March 10, 2017

USD/JPY Is At A Crossroads

The US Non-Farm Payrolls data turned out to be considerably better than expected, but despite that the market seems inclined toward USD depreciation.

Still, I am fond of technical analysis and my personal view is that news serve mainly as catalysts for market movement, while one can read the inclination of the market on the chart. Which is why I will focus on the USD/JPY chart.

In my opinion, here the technical analysis picture can be filled out with two more trend lines (the thick red ones). The pair broke out above this trend channel with height of about 330 pips yesterday toward the end of the American session, but the pair reached a resistance at 115.50 and could not continue moving to the upside.

I think that there are two medium-term scenarios:

The first scenario is that there will be a correction and a renewal of the move to the upside toward 117.00 – 117.50.

In the alternate scenario there will be a move to the downside with first target at 113.50.

Thursday, March 09, 2017

GBP/JPY Is Forming A Wedge

The GBP/JPY pair is forming a wedge on the H4 time frame, its four points are already clearly identifiable.

Most traders are aware of this, but I will clarify again just in case anyone is wondering why the numbers 3 and 4 are placed several times on the screenshot – we can count a point as a consecutive if the price has touched the opposite trend line before that.

In points 3 and 4’s case, the price has not reached the opposite trend line and it has retraced to test the same trend line, which is why we mark these tests again as 3 and 4.

When we have a wedge pattern we can trade the pair both within it or (which is the best case scenario) – to wait out for its development, a breakout above or below its trend lines and then to look for its limit. Make no mistake – there can be a breakout in either direction. Which is why it is necessary to have the patience to wait out said breakout, which in this case has a serious limit: over 300 pips.

Wednesday, March 08, 2017

Today’s USD/JPY Move To The Upside Fulfilled My Expectations

Something very interesting and expected, in my opinion, happened on the USD/JPY chart.

The pair was range-bound for several days, testing the bottom of the correction of the move to the upside from 28th February 2017 at 113.556, forming a double bottom and prompting traders to start aggressively opening long positions.

Today’s high at 114.747 is exactly 9 ticks higher than the one from 3rd March 2017 which was at 114.756 – at least for the moment.

Adding the presence of a RSI divergence that hasn’t reached its limit yet, which I have mentioned several times and which I am watching closely, as well as one larger wedge (in red), the limit of which also hasn’t been reached, my priority expectation is that the move to the upside will continue.

In the alternate scenario a double top will form after which there will be a strong move to the downside.

Tuesday, March 07, 2017

Trade Forex With ActivTrades

ActivTrades

is a leading online Forex broker with which you can trade a large number of

major, minor and exotic currency pairs, as well as metals, at low spreads

starting from 0.5 pips and with leverage of up to 1:400 on three different

platforms – ActivTrader, Metatrader 4 and Metatrader 5. ActivTrades also offers

many practical, helpful tools that can make your trading easier, such as

SmartOrder 2, SmartLines, SmartCalculator and others.

Trading

with ActivTrades is completely transparent, there are no hidden fees or

commissions. You can trade various sizes (as low as micro lots), use automatic

trading strategies, while having a constant access to a dedicated,

professional 24/5 customer support, from Sunday 11 p.m. to Friday 11

p.m. CET.

For more

information about trading with ActivTrades click here>>>

Monday, March 06, 2017

USD/CAD Today

It seems that my expectation that USD/CAD would reach 1.36 turned out to be a little bit over the top.

On the daily time frame the pair has reached a resistance that it will have a difficult time overcoming.

The highest local high for the moment is at 1.34364 and a RSI divergence appeared on the H1 time frame, which also hints for a possible move to the downside.

This pair, however, is strongly dependent on the price of the LCrude, so obviously no developments happens swiftly or easily.

In case a move to the downside does begin, I think it should lead the pair once again to 1.3090 and possibly below that level.

In case the pair starts moving to the upside again, we could see it reach 1.36.

Friday, March 03, 2017

USD/JPY Began A Correction To The Downside

USD/JPY reached a strong resistance level in the 114.50 – 114.60 zone and, as it could’ve been expected, it began a correction.

For the moment, however, the pair is in no hurry to drop sharply and that is logical, considering that the limit of the wedge (in red) has not been reached yet.

In my opinion we could expect some correction on a smaller time frame, maybe on H1 or M30, after which the pair will continue rising toward 114.80 – 114.90.

As usual, the moment there were three points I drew two possible trend lines. The way the pair develops between them will show whether there will be any changes and what they will be.

In case there is a breakout below the support trend line, my supposition will need to be corrected. In that case the first target will be at 53 pips to the downside from the breakout level.

We should not forget that after (and if) the limit of the smaller of the two wedges is reached we will likely see a considerably deeper correction. There is also a second wedge (in blue), which, if it is drawn correctly, could lead the pair to around 119.60.

Thursday, March 02, 2017

The EUR/USD Prognosis For Today

EUR/USD is well known for its volatility and mercurial behavior, which is not hard to explain with the fact that it is one of the most popular to trade currency pairs and it’s influenced by all sorts of contradictory financial interests. The bulls and bears are in a constant conflict and that struggle for dominance never ends.

So it is very logical that for the past seven days (from 22nd February to 2nd March 2017) the pair moved from 1.04934 to 1.06304 and back to 1.04985 while being range-bound, forming a double bottom but without reaching a lower low.

The divergence on the daily time frame (in red) still hasn’t reached its limit, but we do know that things often happen slowly with this pair.

It is quite possible for it to drop further and to form a double bottom on the weekly time frame, and only then to start moving to the upside, i.e. to fall to 1.0350 and then to begin rising toward 1.09 – 1.11.

In the alternate scenario EUR/USD will renew its impulse move to the downside that began on 1st May 2014, which technically could lead the pair way below parity. That, of course, is a very long-term prognosis which we should still keep in mind just in case.

Wednesday, March 01, 2017

USD/CAD Rallied After Donald Trump’s Speech

Yesterday’s speech by Donald Trump before the US Congress served as a catalyst for all currencies related to the USD, including USD/CAD.

After the breakout below the support trend line on the weekly time frame the pair fell to 1.2969, but after four weeks of range and bars (on the same time frame) that suggested that it would not continue dropping, USD/CAD climbed back up to the trend line it had broken below.

In my opinion, the most probable scenario is for the pair to continue rising toward 1.36 and only after it has reached that level to renew its move to the downside.

The target to the downside is still 1.26, but for the moment that appears to be a rather long-term prognosis and it’s unclear when the pair will reach it.

Subscribe to:

Posts (Atom)