The Bank of Canada will soon announce its interest rate and from now the expectation is for a rate hike from 1.25% to 1.50%.

If that should really happen, the CAD will, without a doubt, rally sharply, but that will ricochet on its American counterpart, which should drop, which in turn will affect the EUR/USD pair.

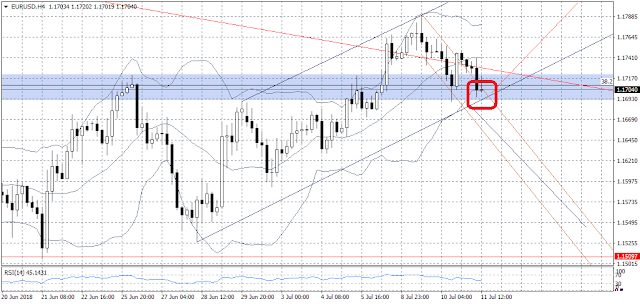

EUR/USD is developing within a strong support zone and if my supposition is correct the move north of the EUR should be renewed. My expectation that EUR/USD will reach 1.1900+ within the A-B-C correction remains completely valid.

The alternate scenario is for a depreciation to 1.1640 so it could gather liquidity and then the pair will continue moving north within that zone.

There may be a new move to the downside first.

ReplyDeleteGood point, I'll keep an eye on the currency pair.

ReplyDeleteGood insight.

ReplyDeleteGood reporting, excellent.

ReplyDeleteExcellent analysis.

ReplyDeleteThanks for such an informative analysis.

ReplyDeleteVery good analysis.

ReplyDeleteDetailed analysis.

ReplyDelete