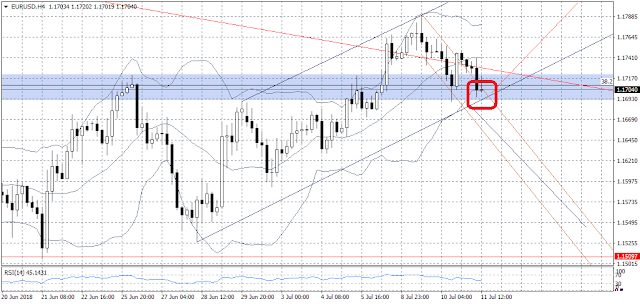

The pair

tested firmly the break out below the trend line (in light blue) and in the

moment it is trading in a consolidation between the trend line, which has

become a support and the dynamic support

above 1.1570.

If we

examine the D1 time frame we could say with certainty that the trend is firmly

bearish. Now we have to see whether there will be a breakout below the support

at 1.1570 until the end of today’s American session or the pair will close the

D1 bar once again below the diagonal support as well as the kind of bar it will

form when it closes.

The

alternative scenario is for a rally to 1.1700 and 1.1750.