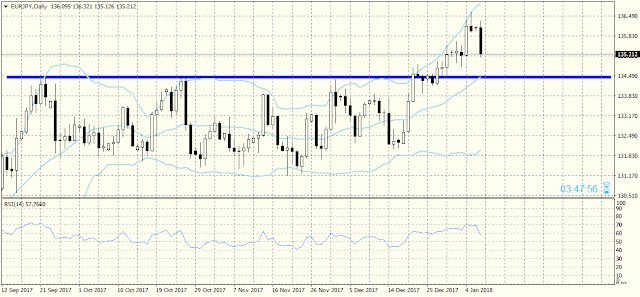

The double

bottom can be seen on the D1 time frame (128.944 on 22nd March 2018

and 129.28 on 22nd May 2018).

Apart from

that the last weekly candle is a pin bar, which confirms the scenario for a

rally of this pair.

If this is

a valid scenario, we could expect a move north to the first resistance at 131.50,

followed by another rally to 132.50. If the pair breaks out above those

resistance levels, we could expect a move up to 133.50.

Under any

circumstances, however, this will be a corrective rally. To the downside there

is a strong support around 127.00 and I think the pair will reach it once it’s

done with the possible correction to the upside.