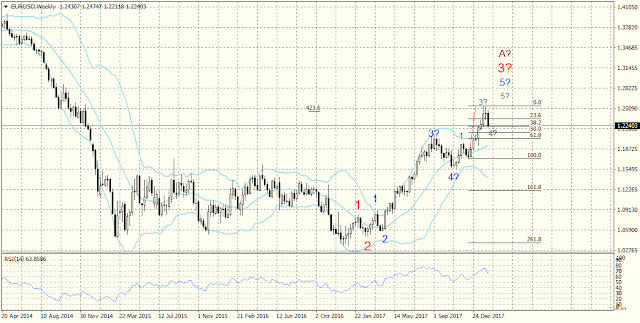

When impulse is in development (according to the Elliott Wave Theory), the movement of any given pair is easily predictable, because the impulse waves develop according to very strict rules. In this case the EUR/USD rally makes no exception.

If we examine the W1 time frame we could suppose that at the moment is developing a fourth wave (in green) from the fifth blue wave, within the third red wave.

If that supposition is correct we can expect that the corrective depreciation that has reached 38.2% Fibo of the supposed third green wave either won’t end at that level or it could develop a little more and reach 1.2125 – 1.2100 which is 50% of the impulse rally of the same wave. After that, I think, we could expect the final rally of the fifth green wave (of the fifth blue) within third red wave.

Excellent analysis!

ReplyDeleteWell spotted! Thanks for sharing it.

ReplyDeleteAs always, very detailed analysis.

ReplyDeleteVery helpful analysis.

ReplyDeleteConsolidation will likely continue until next week.

ReplyDeleteGood post!

ReplyDelete